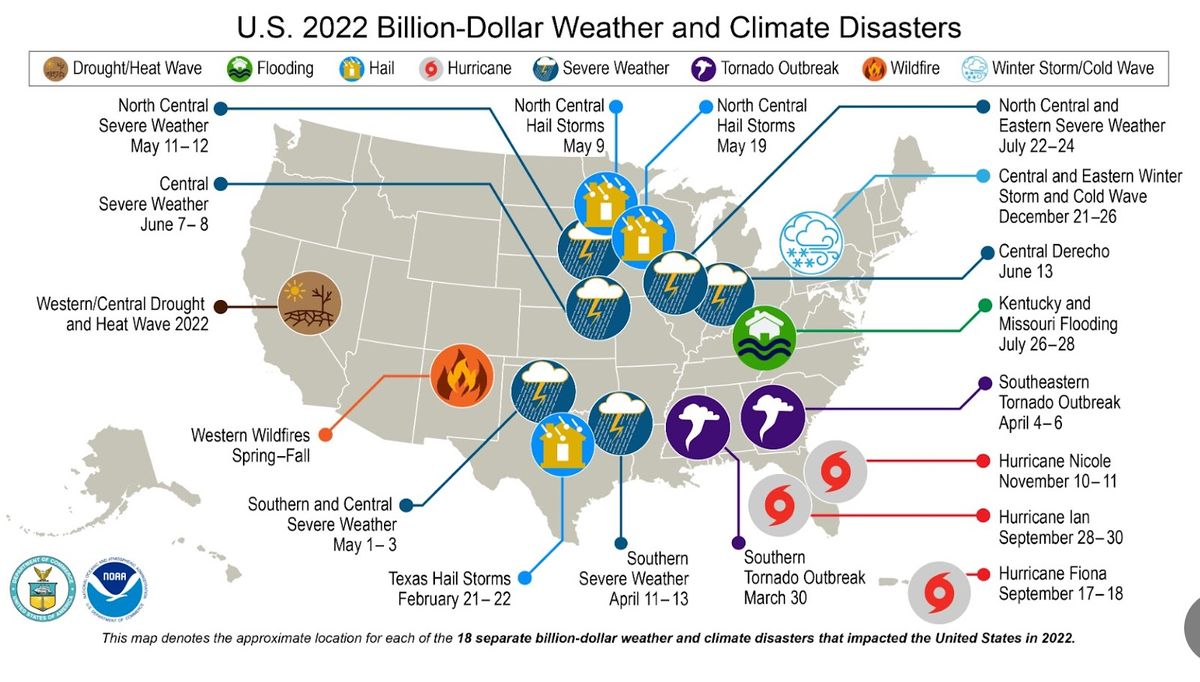

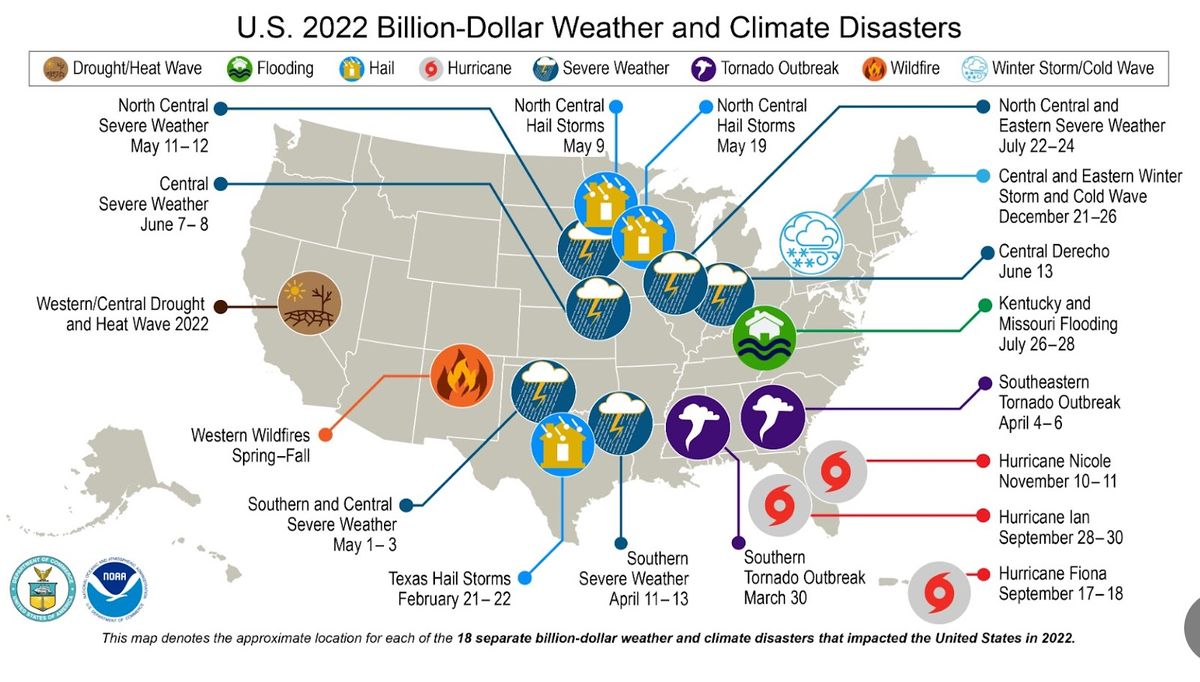

2022 brought home the impact of climate change on home insurance premiums

On average, Minnesotans saw a steep rise in the cost of homeowners insurance after a year of costly disasters.

On average, Minnesotans saw a steep rise in the cost of homeowners insurance after a year of costly disasters.

Get the latest headlines in your inbox once per week.