What's the deal with rising home insurance rates?

It has something to do with expensive disasters

It has something to do with expensive disasters

We're talking disasters this week

Greetings friends. Nora here. I hope you've been staying safe and dry. Minnesota has been particularly snowy this year, and we're due for another cold snap.

I enjoy it even though I've damaged multiple boots and winter-coat zippers with all the extra use this winter.

Extreme weather is becoming more common. The story and column I have for you today cover major natural disasters that are racking up costly damage and taking lives.

If you own a home, you very likely saw an increase in the cost of homeowners insurance.

We've got a very informative piece on that topic. There aren't a lot of tried-and-true solutions to this rising cost, but there are some possible interventions. Check out this great reporting from college junior Landon Peterson.

And be sure to stay for a column by junior Lauren Funke on the cost of disasters abroad.

I learned a lot editing these students, and I'm sure it'll be enriching for you too.

Thanks for being here!

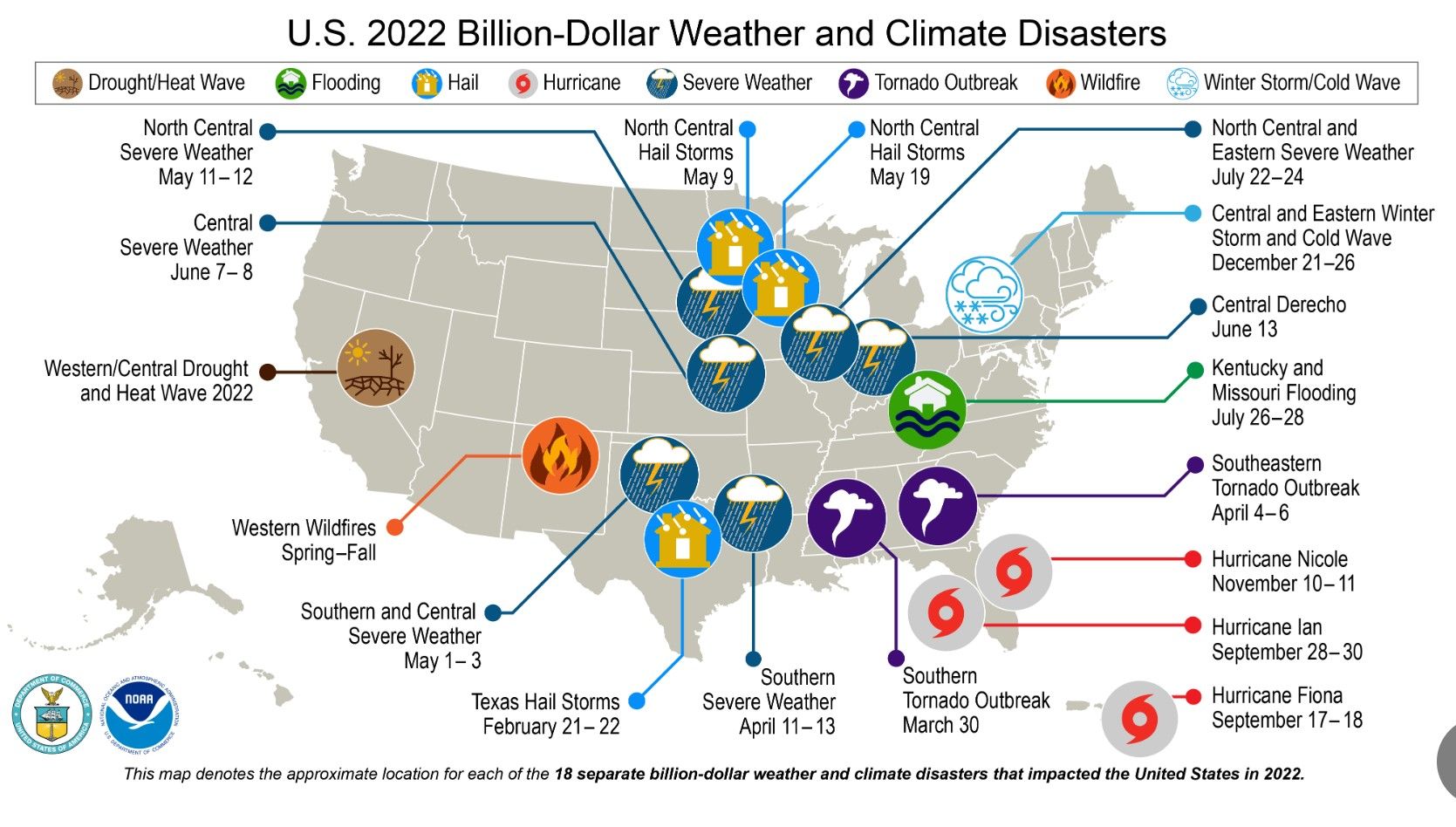

In 2022, there were 18 weather/climate disaster events with losses exceeding $1 billion each to affect the United States. These events included 1 drought event, 1 flooding event, 11 severe storm events, 3 tropical cyclone events, 1 wildfire event, and 1 winter storm event. Overall, these events resulted in the deaths of 474 people and had significant economic effects on the areas impacted. The 1980–2022 annual average is 7.9 events (Consumer Price Index-adjusted); the annual average for the most recent 5 years (2018–2022) is 17.8 events (CPI-adjusted). (Details and map courtesy of the National Oceanic and Atmospheric Administration)

2022 brought home the impact of climate change on home insurance premiums

On average, Minnesotans saw a steep rise in the cost of homeowners insurance after a year of costly disasters

By Landon Peterson for Project Optimist

This story is part of a grant-funded program at Project Optimist that involved basic journalism training for student and community reporters in central Minnesota. A group of 20 environmental studies students received the training, did field reporting at the U.N. Climate Change Conference and filed stories that highlight their research. Landon Peterson is a junior at the College of St. Benedict and St. John’s University (originally from Minneapolis, Minn.) with a major in political science and minors in peace studies and English. He’s also managing editor at the school’s newspaper, The Record.

Last May, a destructive storm rolled through Minnesota, containing “some of the most extreme thunderstorm winds in recent years,” according to a report by the Minnesota Department of Natural Resources.

With winds greater than 80 mph, the effects of the storm were severe: two fatalities and expensive, physical damage to agricultural structures, homes, garages, hangars, trees and semi-trucks, some of which blew over on Interstate 94. The storm also downed power lines, knocking out power to tens of thousands of businesses and homes.

Extreme weather like this is becoming more and more common in Minnesota. Since 2000, the state has seen a significant increase in devastating, large-area rain, hail, and thunderstorms. In 2022, Minnesota experienced $5.1 billion in disasters, the most in history and a sharp increase from $1.0-2.0 billion in 2021. Climate projections indicate that these high-cost weather events will continue to increase in the future.

The rise in extreme weather has a significant adverse effect: a steep rise in homeowners insurance costs. On average, Minnesota homeowners paid 13.9% more for home insurance in 2022 than they did in the prior year.

That increase ranks Minnesota eighth in the United States for largest increases, at a time when 90% of homeowners across the country have seen their home insurance premium rise since May 2021. The average increase nationwide is $134.

Homeowners spend around 1.91% of their household income on home insurance. That increase will have a minimal effect on those who had no problem paying previously, but for low- and moderate-income individuals and families, the rising cost inflicts a significant burden. The average monthly price of homeowners insurance in the United States for $250,000 in dwelling coverage is around $115, a potentially make-or-break payment when stacked alongside other living expenses.

Flood waters lap at a high water warning sign that was partially pushed over by Hurricane Florence on Oak Island, North Carolina, on September 15, 2018. (REUTERS/Jonathan Drake TPX IMAGES OF THE DAY)

In November, the United Nations Climate Change Conference (COP27) in Sharm El-Sheikh, Egypt, highlighted a number of different innovative strategies for governments, insurers and organizations to consider.

Ekhosuehi Iyahen, Secretary General of the Insurance Development Forum, a collection of public and private insurance stakeholders dedicated to risk management, praised Global Risk Modeling Alliance and other public-private partnerships that enable data sharing between insurance companies and governments. Many insurers are refusing to fund carbon-intensive and other climate-negative projects, like the more than 30 insurance companies that have limited the underwriting of coal projects, offering the potential to make major headway against climate change.

Local strategies appear to be less prevalent. An “Investing in Resilience” panel at COP27 highlighted a Resilient Cities Network initiative that brought insurance experts to Indonesia to speak with and educate prospective consumers on the benefits of property and casualty insurance. It’s unclear if a strategy like that would be applicable in Minnesota, where coverage and insurance options are widespread.

Look for the Minnesota Legislature to consider several options that increase home affordability during the 2023 session. One route may be to offer home insurance incentives for consumers that reinforce their homes to higher building codes, a unique public-private partnership that has had success in Alabama.

Home insurance can promote development and offer investment protection. However, rising rates may force consumers to opt-out of insurance or prohibit potential purchasers from being able to buy.

Much needs to be done to stabilize rising insurance rates in the face of climate change, in Minnesota and beyond.

As Selita Pulini Tikoibua, Pacific Coordinator for the Loss and Damage Youth Coalition, highlighted at COP27: “Often, those who have done the least to cause climate change suffer the most.”

Landon Peterson is a junior at the College of St. Benedict and St. John’s University (originally from Minneapolis, Minn.) with a major in political science and minors in peace studies and English. (Courtesy of Landon Peterson)

For more, check out Next City's story: What Alabama Can Teach You about Storm Resilience

Newsletter continues after the promotion.

Promotion from Project Optimist

We're hiring!

Help create more optimism: Come work with Project Optimist! If you want to bolster the future of journalism and democracy, build community and inspire problem solvers, this is the workplace for you. We support employee mental health and professional development. You can help build the foundation for this important work!

See the posting and learn what you need to apply!

Column

Emotional appeals at COP27 gave weight to the need for international funding

By Lauren Funke for Project Optimist

This story is part of a grant-funded program at Project Optimist. Lauren Funke is a junior at the College of St. Benedict and St. John’s University (originally from St. Paul, Minn.) with a major in environmental studies.

I walked around the COP27 conference, weaving through the crowd of rushing people. There were almost a hundred meeting halls, some big enough to hold a sold-out arena and some that could only seat twenty people. I stumbled across a room that was packed full hosting a panel called Frontline Solutions to the Climate Crisis. The event was held in a room that could seat a hundred people. Every chair was filled, and there were people standing against the walls and crowded by the entrance. This panel was unlike any other I attended at the conference. It was by far the event with the rawest emotion and compassion.

There were panelists from the Philippines, Guam, Malaysia, Puerto Rico and Florida telling their stories of how climate change has devastated the health of their land and people. One woman pleaded for developed countries to provide financial support because floods are killing her people and causing so much damage that they cannot recover. As she spoke, the room was silent and I saw compassion and tears on faces throughout the audience. Once she was done, the room roared with applause and shouts of acknowledgement.

Climate change is having a detrimental impact on millions of people across the world, and the people in the most vulnerable positions are pleading for financial support from developed countries so they can survive.

Damage caused by Typhoon Mangkhut in downtown Hong Kong, September 17, 2018. The 2018 storm also hit the northern part of the Philippines. It killed more than 120 people and caused about $3.77 billion in damages. (Thomson Reuters Foundation/Beh Lih Yi)

The term loss and damage refers to the impacts of climate change, from both slow-onset events like sea-level rise and desertification, and extreme weather events like cyclones and droughts. Impacts include economic losses such as lost agricultural income or damaged infrastructure and property. It also includes non-economic losses such as loss of life, cultural heritage and Indigenous knowledge.

There have been policies implemented to address loss and damage on a global scale, according to the United Nations Framework Convention on Climate Change. These include the Warsaw International Mechanism for Loss and Damage and the Paris Agreement, but these policies have not been hugely effective because they use vague language that does not require countries to act.

Countries vulnerable to climate change have not benefited from these policies and instead, they are asking for a global finance facility that will compensate for loss and damage. Developing countries suffer disproportionately negative impacts of climate change even though developed countries are the greatest contributors to greenhouse gas emissions, according to Minnesota Interfaith Power & Light.

The global finance fund would be funded by developed countries who have the highest emissions, and the use of funds would be governed by vulnerable countries. This ensures that vulnerable countries are free to use funds most effectively based on their knowledge of the land. It also prevents developed countries from using the funding they provide as leverage to require that vulnerable countries act according to the agenda of the developed world.

At COP27 I spoke with a dozen people from vulnerable countries, and they all strongly supported the idea of a global finance fund. I interviewed Sandra Guzman who is a woman from Mexico and is the founder and coordinator of the Climate Finance Group of Latin America and the Caribbean. She explained that even though some climate finance is being given to vulnerable countries, there is still much more work to be done.

“What is needed is far more than that [climate funding given so far]. The needs report published by the Standing Committee on Finance says that we would need at least $5.8 trillion by 2030. This is more or less $529 billion per year,” said Sandra Guzman, when I interviewed her on November 14.

Achieving success on this scale will require a structured fund like the global finance facility that has a system to hold countries accountable for their pledges.

I interviewed Mary Tahu Paia who is a woman from the Solomon Island National University and is also a member of the Solomon Islands Network. She explained her frustration in the difficulty of developing countries obtaining loss and damage funds and requested that countries have direct access to funds instead of going through an extensive legal process.

“Today we are not given access to funds. One time I was drafting a proposal for this woman in the climate action network and it was turned down because you have to have a lot of criteria and process and most of these women don’t even know how to write. But they understand the environment, they know the changes. They have observed them over the years,” Tahu Paia said when I interviewed her on November 15.

It is clear that the extent of loss and damage due to climate change is devastating many countries, especially those that are most vulnerable. It is also clear that the most-developed countries have contributed the largest amount of greenhouse gas emissions and are suffering the least due to their capacity to adapt.

After attending COP27, performing literature analysis and conducting interviews with people from vulnerable countries all over the world, I conclude that the next step in mitigating climate change is to implement a global finance fund. This is necessary for the survival of infrastructure, families and cultures in vulnerable countries. And it is possible.

Most importantly, for effective change to occur, our global leaders must consider loss and damage a serious issue. They must remember the devastation in the panelist’s voices from Frontlines Solutions to the Climate Crisis as they told us their communities are dying. They must remember the flood of tears and fear that filled the room at the end of this event. We must acknowledge that countries such as the U.S. are responsible for a large amount of the world’s greenhouse gas emissions, and it is our moral obligation to help vulnerable countries that are suffering immensely from climate change. Our global leaders need to keep this all in mind when discussing how much financial support will be given to vulnerable countries. Loss and damage was discussed briefly at COP27, but the topic must be given much more attention at COP28 to show the intensity and urgency it requires.

Lauren Funke is a junior at the College of St. Benedict and St. John’s University (originally from St. Paul, Minn.) with a major in environmental studies. (Courtesy of Lauren Funke)

Read more about it

From Project Optimist: COLUMN Necessary and imperfect: Finance programs for countries hit hard by climate change

From Carbon Brief: Analysis: Why climate-finance ‘flows’ are falling short of $100B pledge

From Carbon Copy: Developing countries need nearly $6 trillion by 2030 just to cover 40% of their NDCS: UN Report

Final thoughts

Thanks readers for making it to the end! I appreciate you!

Remember that Project Optimist is hiring for the first time. Visit our job posts so you can apply or share the details with potential applicants.

We've got two job openings!If you need a palate cleanser after all this disaster talk, I highly recommend this Mary Oliver poem.

Be well.

♥ Nora Hertel, founder of Project Optimist

Our mailing address:

P.O. Box 298

St. Michael, Minnesota 55376

Copyright © 2023 The Optimist, All rights reserved.